Gusto stands out in a crowded field of the best payroll services. It provides a smart set of commonly used payroll tools for small to medium-size businesses (SMBs) and an exceptional user experience that works well for both experienced payroll managers and those unfamiliar with it. New and enhanced features include customer reporting and more flexible data import. Gusto earns an Editors’ Choice award for novices running SMBs because of its usability, customizability, mobile access, comprehensive setup tools, and management of payroll runs. Two other Editors’ Choice winners in the payroll software category are ADP Run for small businesses that are poised for growth and OnPay for larger SMBs and those in vertical industries.

How Much Does Gusto Cost?

Gusto comes in four versions:

-

Contractor Only ($35 per month plus $6 per person per month)

-

Gusto Simple ($40 per month plus $6 per worker per month)

-

Gusto Plus ($80 per month, plus $12 per employee per month)

-

Gustom Premium (custom pricing)

The Contractor Only plan lets you pay as many US-based contractors as you need. You can pay international contractors in more than 120 countries for extra fees that vary. The $35-per-month base fee is waived for the first six months.

Gusto Simple includes basic payroll processing, standard reports, and the option to use Gusto-brokered health insurance administration. Gusto Plus, the tier I reviewed, adds time tracking and advanced HR tools for things like performance reviews and paid time off management. The Premium level has special features and capacity for large teams, including a dedicated point of contact at Gusto for help and integration options for health insurance brokered by other providers.

Of the payroll services I’ve reviewed, Gusto Plus is the most expensive. OnPay is the best value because you get robust payroll and HR tools for $40 per month plus $6 per employee per month, without the extra fees that Gusto charges. Square Payroll and Workful are the least expensive, at $35 per month plus $6 per employee per month. They’re good choices if you have primarily hourly workers and don’t need a lot of extra HR tools. For example, Workful is suitable for households that want to pay a nanny or other household help using payroll software.

Getting Started With Gusto

Like its competitors, Gusto walks you through setup, prompting you on what it needs at each step, like payroll bank account information, time off requests and policies, connections to integrated apps like Microsoft 365, and pay schedules. Gusto is especially flexible at the latter. You can even set up pay schedules by compensation type, employees, and departments. If you’ve been running payroll using another method, you need to provide details on your payroll history. Gusto specialists can help with this. They can also assist with Gusto’s new data import capabilities, which let you bring in employee records stored as spreadsheets, for example.

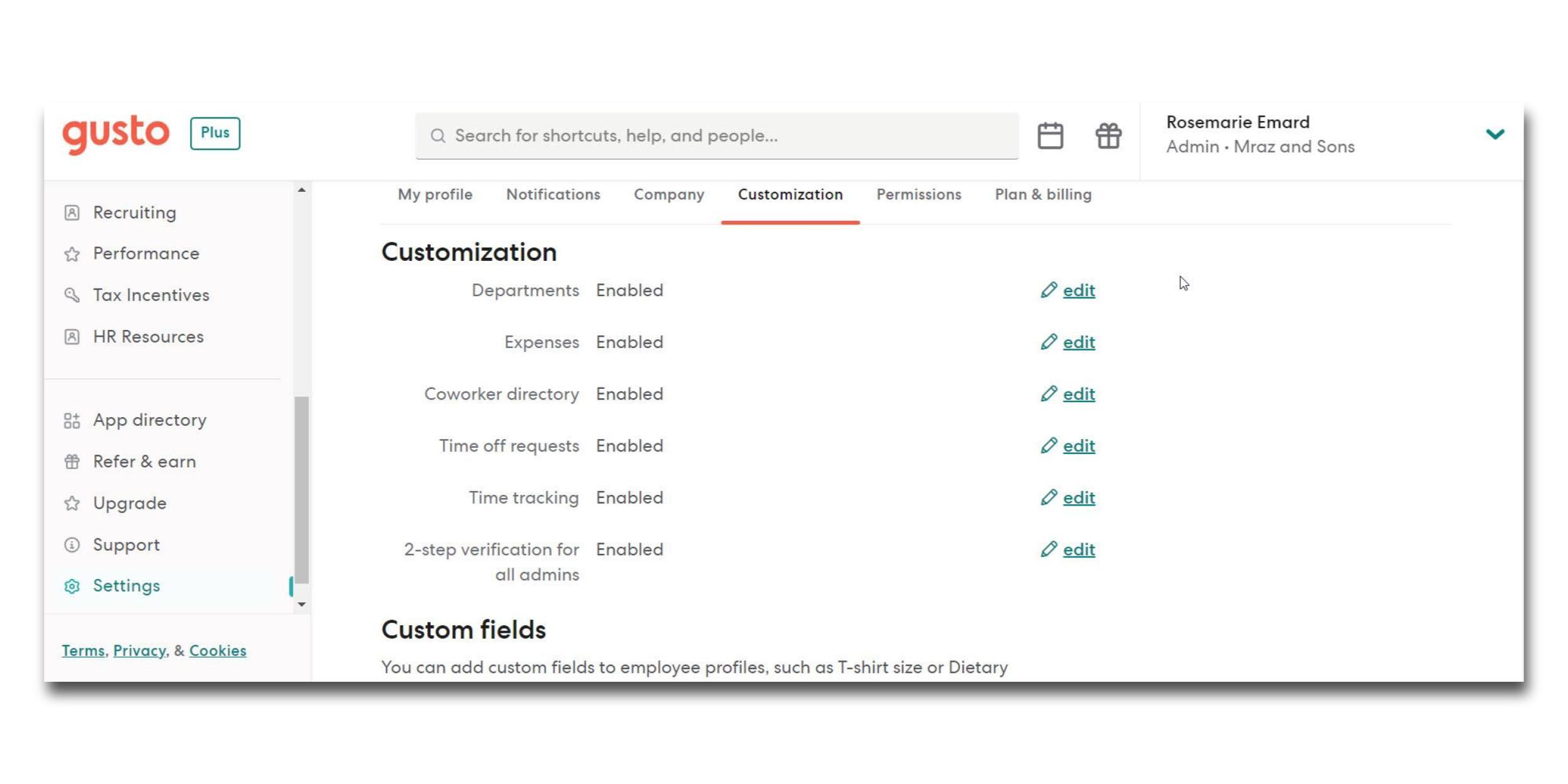

I like how comprehensive the site is here, though Gusto does charge extra for some tasks, like assistance with state tax registration (Patriot Software Full Service Payroll has it for free). And similar to OnPay, Gusto supports custom fields.

(Credit: Gusto/PCMag)

What Sets Gusto Apart?

Gusto’s usability, aesthetic qualities, exceptional payroll processing tools, and its expansive support for benefits set it apart from most other payroll services for small businesses.

A lively, attractive, intuitive UI isn’t what’s required to process payroll—flexible, understandable tools are. Gusto has both, and it’s one of the reasons this service is so effective. I’ve never gotten lost while working my way through its payroll processing tools and all the features that support it. That it’s good-looking and almost fun to use is a bonus. I like its user experience better than any other app I’ve tested for small business payroll.

Pared-Down Employee Records

Employee records are the core of your payroll application. All payroll services show you a common set of worker attributes, like contact information, compensation details, time-off use and accrual, benefit assignments, and HR documents. Each adds its own extras, like ADP Run’s Skills and Training.

ADP Run supports more comprehensive profiles than any other payroll service for SMBs I’ve seen, but I like Gusto’s handling of this key element, too. Gusto’s employee records show the details that payroll managers are likely to need the most without overwhelming them, including compensation, time off, and benefits. And like the rest of Gusto, these pages are clean and understandable—and they look great.

(Credit: Gusto/PCMag)

How Do You Run a Payroll With Gusto?

Gusto offers its own tracking tools and timesheets, but you can also bring hours in from integrated applications like QuickBooks Time or any device that connects to the internet, or you can enter them manually. You do most of your payroll work on the first page, which includes salaried and hourly workers but not contractors (they’re paid separately). As in competing payroll services, core payroll items like hours worked, bonuses, and reimbursements always appear.

(Credit: Gusto/PCMag)

Links take you to additional options on this page. You can view benefits, edit deductions, and add other earnings types that you’ve created and assigned to employees. Employee records open in new browser tabs, so you can consult them without losing your place in the payroll. Time-off entries, which show each worker’s remaining hours, appear on a separate page, which prevents overcrowding on the main page.

Before you submit your payroll, you see a terrific page that breaks it down beautifully into taxes, employee hours and earnings, and company costs. You can still cancel your payroll after you’ve submitted it and Gusto will retain a copy of it.

(Credit: Gusto/PCMag)

What Kind of Help Does Gusto Offer?

Gusto builds simplicity into its friendly design, and it’s backed up by tons of help files with easy-to-understand, step-by-step instructions. Unlimited chat, email, and phone support are available should you need additional help.

Standard and Custom Reports

Gusto has done a lot of work to improve its reports over the last year. It has always offered a good set of standard report templates that can be customized and displayed or exported in PDF, CSV, and Excel. The Payroll Journal report is exceptionally customizable because it’s powered by Gusto’s new custom report tool. You drag and drop columns to the desired positions, filter the report, specify a date range, and save it as a template. It’s a terrific tool.

(Credit: Gusto/PCMag)

Gusto provides a robust set of HR tools that cover help with hiring and onboarding, compliance, and talent management (performance reviews and goal tracking, for example). It offers standard retirement plans, as well as medical, health savings accounts, flexible savings accounts, dental, vision, life insurance, and disability coverage. You can keep your own broker and manage benefits through Gusto (fees may apply) or change your broker to Gusto.

Payroll deductions can be set up for additional benefits, like gym memberships and charitable giving with employer matches. Expert HR help, priority support, and extras like compliance alerts and other HR support are available, but they cost $8 per employee per month, added to your Plus plan fees.

Is Gusto Safe to Use?

All data transferred between the user’s browser and Gusto’s servers is encrypted in transit using TLS v1.2. It uses Amazon Web Services to host its production servers, databases, and supporting services. Its production systems and data are backed up on a regular basis. Multi-factor authentication is supported, and Gusto proactively monitors customer accounts to help prevent fraudulent transactions.

No Mobile Apps, But Thorough Mobile Access

Gusto doesn’t have standalone mobile apps and apparently doesn’t even optimize its website for mobile use, but you can log in using a mobile browser. The mobile site seems to mirror the desktop site, so you should be able to do everything you can on a larger screen—but you can’t always, or at least not effectively. For example, I was able to run a payroll with the phone held sideways, but the payroll summary is too massive to see well. Employee records worked better, but I wasn’t able to run a custom report, which is admittedly something you would only do on your desktop.

Intuit QuickBooks Payroll has better mobile access if that’s a factor that’s important to you when choosing a payroll service.

(Credit: Gusto/PCMag)

Is Gusto Right for Your Business?

Gusto could be right for a lot of businesses, both small and medium ones. Its usability and exceptional user interface appeal especially to start-ups and very small businesses, and its deep payroll and HR tools will please larger businesses as well. It hits the sweet spot in every area but cost. Gusto is a well-deserved Editors’ Choice winner, alongside OnPay, recommended for larger SMBs and those in vertical industries, and ADP Run, for small businesses that may grow well beyond the bounds of one.

Pros

View

More

The Bottom Line

Gusto appeals to both new and experienced payroll administrators because of its usability and top-notch payroll setup and processing.

Like What You’re Reading?

Sign up for Lab Report to get the latest reviews and top product advice delivered right to your inbox.

This newsletter may contain advertising, deals, or affiliate links. Subscribing to a newsletter indicates your consent to our Terms of Use and Privacy Policy. You may unsubscribe from the newsletters at any time.