The United States has devised a comprehensive strategy to counter Huawei and gain dominance in global telecommunications. At the heart of this strategy is a battle for control over the architecture that powers mobile communications and the Internet.

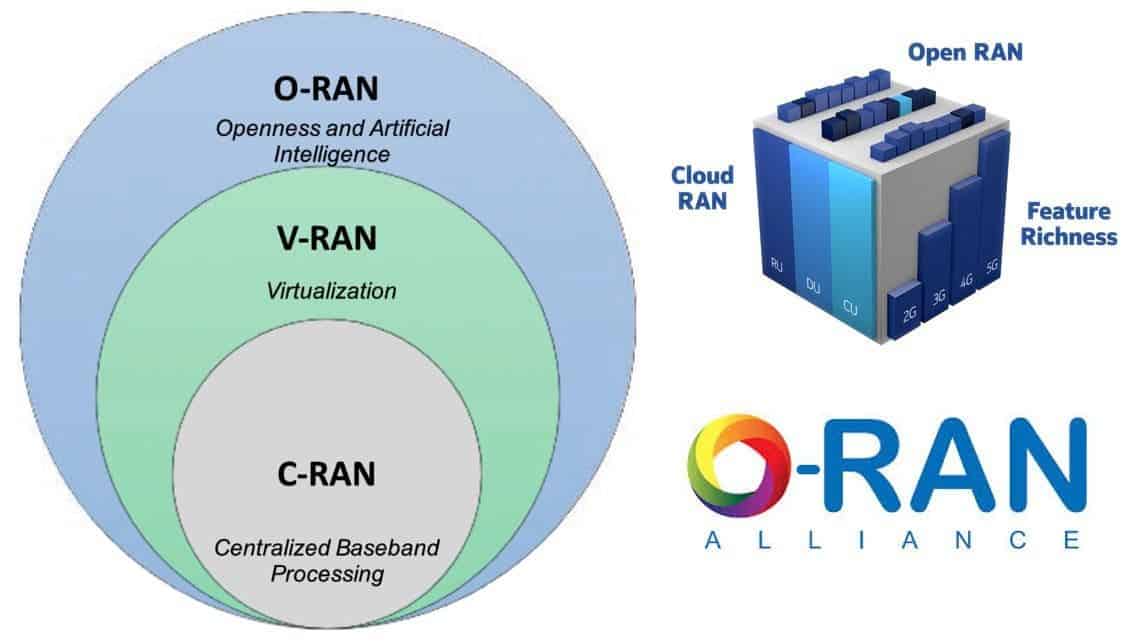

In this competition for cyberspace supremacy, China champions the traditional Radio Access Network (RAN) architecture, which forms the radio component of cellular networks. Meanwhile, the US is backing an emerging technology known as Open Radio Access Network (O-RAN).

The motivation behind the US’s support for O-RAN is clear: it aims to permanently dethrone Huawei from its position as the leading telecom equipment vendor worldwide.

To achieve this goal, the US is leading a concerted effort domestically and internationally to advocate for the adoption of O-RAN over traditional RAN. This strategic shift would undermine Huawei’s dominance and mark the end of its reign in the telecom industry.

According to The Washington Post, US President Biden has reached out to the leaders of India, the Philippines, and Saudi Arabia, urging them to embrace O-RAN technology. This outreach is a key component of a broader campaign aimed at encouraging countries to adopt Open RAN while avoiding reliance on Huawei.

To support this initiative, the US Congress has allocated $500 million to the International Technology Security and Innovation (ITSI) Fund for the development of O-RAN technology. Additionally, the country’s Public Wireless Supply Chain Innovation Fund, authorized by the National Defense Authorization Act (NDAA), has provided an additional $1.5 billion to accelerate the implementation of O-RAN.

What is RAN? (Huawei US)

A Radio Access Network (RAN) is a critical component of telecommunications infrastructure, facilitating the connection of wireless devices to different segments of a central network, whether public or private. Essentially, the RAN serves as the radio component of a cellular network.

Control over RAN infrastructure translates to control over the internet due to its vital role in wireless device connectivity. A monopoly over such infrastructure is advantageous for the controlling entity but poses a threat to others.

In a conventional RAN setup, the radio, hardware, and software are proprietary, typically originating from a single supplier. This restricts operators from mixing radios from one vendor with hardware and software from another when deploying a network. Such arrangements characterize the status quo of mobile communication networks.

Currently, the RAN landscape is dominated by a small group of companies, including China’s Huawei and ZTE, Scandinavia’s Ericsson and Nokia, and South Korea’s Samsung. Huawei, in particular, holds the global leadership position in supplying RAN equipment, presenting a significant challenge for the US.

What Does O-RAN Mean?

An Open Radio Access Network (O-RAN) is an open-source version of traditional Radio Access Network (RAN) infrastructure. It enables interoperability among cellular network equipment provided by different vendors.

The US’s push for O-RAN is grounded in the belief that having multiple suppliers provides an alternative to closed end-to-end systems reliant on Chinese equipment. This strategic shift aims to disrupt Huawei’s dominance in the market.

Huawei Against US and the West

Concerns surrounding the use of Huawei’s equipment stem from suspicions that the company is closely tied to China’s ruling communist party, potentially leveraging its technology to gather signals intelligence (SIGINT) on Western adversaries, including the US. Former US President Donald Trump voiced these concerns in a 2019 interview, stating, “We don’t want [Huawei’s] equipment in the United States because they spy on us.”

Widespread suspicion and opposition against Huawei among Western governments and companies began in 2012 following a series of cyber-attacks targeting US companies and Western governments, with many attributing the attacks to China. In response, a US congressional committee in 2012 approved a proposal aimed at identifying and removing technology developed by Chinese telecommunications firms from the US nuclear weapons infrastructure. Additionally, the US House Intelligence Committee concluded that both Huawei and ZTE Inc. posed national security threats.

However, Digitimes analyst Benson Wu suggests that the official reasons cited by the US for avoiding Huawei’s equipment may be disingenuous. He believes that economic and protectionist motives could be driving the effort to remove Chinese technology from the US telecoms system, rather than solely national security concerns as claimed by US politicians. Benson points out that Huawei has been used in the US for longer than commonly believed, and security concerns were not raised when Huawei provided infrastructure for 2G and 3G communications.

Benson argues that the assertion that the US is restricting Huawei’s access to the country due to national security concerns lacks logical consistency. He points out that companies from other communist countries, such as Vietnam, are not subjected to similar restrictions. This observation raises questions about whether national security is the sole motivation behind the US’s actions against Huawei.

US O-RAN Targets Huawei Dominance

Benson noted that O-RAN initially emerged as a commercial concept but was later embraced by US authorities as a means to exclude Huawei and China from the US telecommunications infrastructure. He emphasized that the US aims to persuade other countries to transition from RAN to O-RAN. However, Benson acknowledged that selling the US proposition presents challenges for various reasons.

Regarding the Huawei issue, Benson highlighted the dilemma faced by major vendors like Nokia and Ericsson. These companies must navigate a geopolitical minefield and balance the interests of both the US and China. In October 2020, Swedish regulators prohibited the use of Huawei in its 5G networks. The following month, Ericsson’s CEO, Börje Ekholm, criticized the blanket ban, advocating for a more nuanced approach. He suggested that Sweden should implement measures to mitigate risks to its 5G network rather than impose a complete ban.

Following the ban, Gao Feng, a spokesman for the Ministry of Commerce, urged Sweden to rectify the decision and seek solutions to preserve economic and trade cooperation between China and Sweden. As a consequence of the ban, Ericsson’s sales in China during the first quarter of 2021 experienced a significant decline.

Gizchina News of the week

Benson pointed out that if Sweden had not followed the US in banning Huawei, Ericsson could have faced restrictions on its access to the US market. This underscores the conflict between political and commercial interests regarding the Huawei issue.

US Faces Challenges

He also mentioned that the US rip-and-replace strategy faces challenges due to market dynamics. Huawei’s equipment is notably cheaper than that of other vendors, complicating the implementation of the rip-and-replace initiative.

Introduced in 2020, the rip-and-replace initiative mandates American enterprises to eliminate telecommunications equipment manufactured by Chinese firms Huawei and ZTE. The US expresses concerns that Beijing could exploit equipment from these companies for espionage and the unauthorized acquisition of proprietary information.

Benson emphasized the urgent need for US operators to find alternatives to fill the equipment void left by the exclusion of Huawei. However, he highlighted a significant challenge: equipment from trusted vendors like Ericsson and Nokia is considerably more expensive than that of Huawei and ZTE.

He pointed out that not all US operators have the financial resources of major players like AT&T. Smaller operators, in particular, face difficulties in affording alternatives to Huawei’s equipment. While the US government is offering subsidies to companies to aid in the rip-and-replace process, Benson noted that these subsidies fall short of making alternatives as cost-effective as using Huawei’s technology.

How Ericsson Took Advantage of the (Huawei US) Situation

Benson pointed out the US$14 billion open RAN deployment deal between US carrier AT&T and Ericsson, highlighting the conflicting motives complicating US efforts to promote O-RAN. He noted that AT&T’s selection of Ericsson raised eyebrows in the telecom industry because Ericsson was not seen as a prominent vendor in the open RAN space and was more associated with traditional RAN architecture.

However, Benson explained that Ericsson’s offering was unique as it included deploying both O-RAN base stations and traditional closed RAN base stations. This approach allowed Ericsson to adopt a Janus-like position regarding the US O-RAN push. It could participate in the O-RAN promotion pushed by the US government while maintaining a stance that didn’t fully commit to it.

Could this be a Cold War Between The U.S and China?

Benson emphasized that the China-US telecommunications standoff shouldn’t liken to a tech cold war because, unlike the Cold War era with competing ideological standards, there’s only one standard in telecommunications: the 3GPP.

He explained that the 3GPP consists of seven national or regional telecommunications standards organizations collaborating to develop protocols for mobile telecommunications. Both the US Alliance for Telecommunications Industry Solutions (ATIS) and China’s China Communications Standards Association (CCSA) are organizational partners within the 3GPP.

According to Benson, geopolitical tensions in telecommunications lead to a division in supply chains. When sanctions are imposed on equipment from a particular country, it results in the formation of two distinct supply chains.

O-RAN Partnership with Chinese Vendors

Benson highlighted the lack of international standard operating procedures for assessing the security of wireless communication equipment, emphasizing that without guidelines, operators have no means of measuring potential risks.

He also discussed the role of the O-RAN ALLIANCE in the context of the US effort to promote O-RAN to diminish Huawei’s dominance. The alliance, comprising mobile network operators, vendors, and research institutions, aims to reshape the RAN industry towards more intelligent, open, virtualized, and interoperable mobile networks.

However, the presence of Chinese vendors within the O-RAN ALLIANCE complicates matters. Benson pointed out the dilemma facing the alliance, stating, “There are some Chinese equipment vendors in it.” He questioned how these vendors could promote an industry aimed at replacing their own products.

Is the U.S Using a Hypocritical Approach on Huawei?

Benson criticized the US promotion of O-RAN as a solution to fears of built-in backdoors in Huawei’s equipment, labeling it as hypocritical. He argued that the US is well-aware of such threats because it has used similar means to spy on targets.

He pointed to the example of the US National Security Agency (NSA)’s PRISM program, which allowed the government to gather user data from major corporations such as Microsoft, Google, Apple, Yahoo, and others. This example suggests a double standard in the US approach to cybersecurity and surveillance.

Security Flaws of O-RAN

Benson warned that O-RAN is not without its own security issues, highlighting its vulnerability to attacks. He explained that while the interoperability and flexibility of O-RAN equipment can offer cost efficiency, they also increase the attack surface for potential bad actors.

Using a metaphor, Benson likened a network to a house. He explained that if a house has only one window, it’s difficult for a burglar to enter. However, increasing the number of windows raises the risk of a break-in. Similarly, the increased complexity and diversity of O-RAN equipment may pose security challenges akin to adding more windows to a house, making it more susceptible to breaches.

Increased Competition, Cheaper Equipment (Huawei US)

Benson highlighted the paradox in the US argument favoring O-RAN over Huawei equipment, suggesting that both options present security risks. He explained that choosing between RAN and O-RAN architecture essentially poses a dilemma: either potentially expose personal data to the Chinese Communist Party through Huawei’s equipment or risk being vulnerable to hacking from various entities, including the US, with O-RAN.

While Benson acknowledged a gradual shift toward O-RAN in the telecommunications industry, he emphasized that this movement is not solely driven by Washington’s influence. He noted that in the short term, vendors may adopt a strategy that combines aspects of both open and closed architectures, as seen in Ericsson’s deal with AT&T.

Ultimately, Benson suggested that telecom operators could favor O-RAN because it offers greater flexibility in equipment selection, fosters competition, and potentially lowers costs.

Conclusion

The US aims to dethrone Huawei by promoting Open RAN (O-RAN), a rival technology for building cellular networks. This US-China battle has split the telecom industry, raising questions about security, cost, and potential hypocrisy. O-RAN offers more competition and potentially lower equipment costs, but it may also introduce new security vulnerabilities.