LensRentals is among the largest, if not the largest, online rental providers for photography, videography, and lighting equipment in the United States. Unlike many rental houses focusing on cinema and film, LensRentals caters to an extremely broad spectrum of cine, hybrid, and stills gear. Alongside their varied roster, the company also delves into maintenance, repairs, and lab testing, and publishes some interesting insights on its blog.

Let’s start with a disclaimer: As large and influential as LensRentals may be, these numbers can’t let us extract definitive conclusions about the market as a whole. LensRentals figures represent rentals only. and in the United States alone. That said – The American market is still the largest, and the nature of rentals leans towards prosumers and professionals. So even if those insights may not gain scientific status they are quite interesting nonetheless. Let’s see what we can learn from them.

Let’s take a look at the numbers

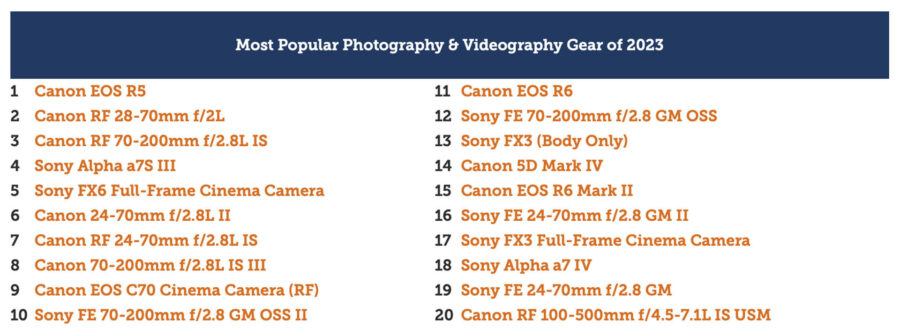

First, we’ll take a look at LensRentals’ most popular gear of 2023. Though absolute numbers aren’t disclosed the available stats provide some insights on the market share LensRentals is working with. The “Most Popular” is calculated by revenue:

An absolute duopoly: Canon and Sony dominate the field, with not a single resurgence from any other manufacturer. In recent years we’ve seen Blackmagic Design and RED claw their way into the list, but 2023 is as mainstream as it gets. A visible tendency towards motion capture is also there. Though the Canon EOS-R5 is more of a stills camera, it also boasts some impressive video capabilities. When it comes to Sony, it’s the a7S III at the top leaving no room for speculation. Lens distribution bears no surprise, almost totally dominating the normal zooms from Sony and Canon. I’d argue that this dual dominance reveals something about LensRentals’ target market than it does regarding the industry. If I had to choose one word to describe this audience it would probably be “mainstream”.

The importance of mainstream

That being said, “money makes the world go round”, and the money is in the mainstream audience. That doesn’t mean this kind of gear will fit your specific project or workflow, but when looking at the broad image, the state and vector of our market are somewhat directed by mainstream currents. Let’s take a look at the changes from last year:

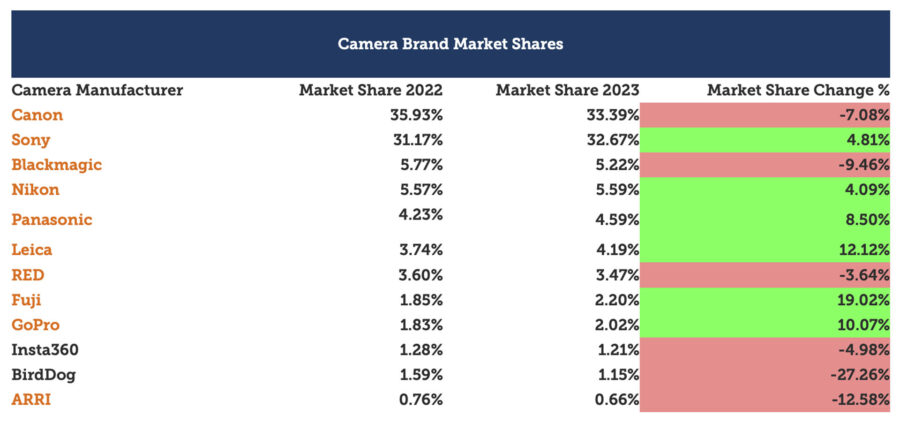

As Sony almost catches up with Canon in the camera segment we can also observe some interesting changes with smaller brands. FUJIFILM has the starkest leap of the year with an almost 20% increase from 1.83% to 2.2%. It’s hard to set causality apart from correlation, but I’d bet that the X-H2S and X-H2 (which was also CineD’s camera of the year in 2022) had something to do with it. Nikon, which was once the runner-up to Canon, managed to claw its way back to the 3rd place. I am missing many factors, such as LensRentals’ inventory of the Z 9 and Z 8, but it seems Nikon still has some way to go if the company is to restore its former glory. Blackmagic suffered a 10% decline, which might be attributed to the model cycle, as the company hasn’t launched a significant new camera for the relevant time. We’ll have to wait for the 2024 report to see if the impressive Cinema Camera 6K will deliver on that front.

Panasonic LUMIX upped by 8.5%. This is no surprise when considering the company’s recent move to phase-detect autofocus (PDAF), and four relatively new cameras. The GH6, G9II, S5II, and S5IIX all serve the mainstream hybrid market in terms of both performance and price.

Lens rentals on LensRentals (sorry)

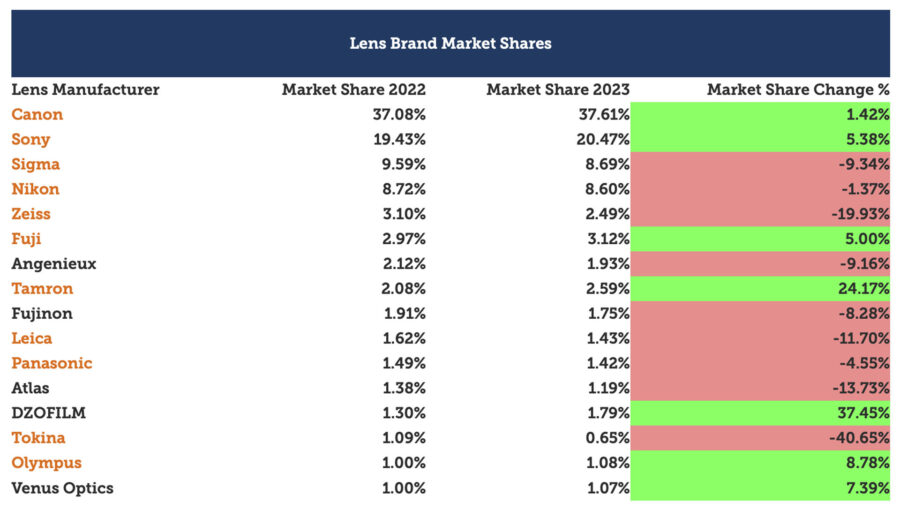

Lens numbers tell another part of this story, as we see rather unsurprising stats when we split by brands. Here Canon maintains its reign with over 37% of the company rentals. Sony managed to expand its share compared to last year but remains around 20%.

SIGMA barely manages to keep Nikon off the third place with an edge of 0.09%, while both SIGMA and Nikon declined compared to last year. DZOFILM presents the most significant rise, 37% compared to last year. However, this rise brings the Chinese company’s share to 1.79%. Tamron made a significant 24% leap to sixth place. But the manufacturer chart tells just one part of the story.

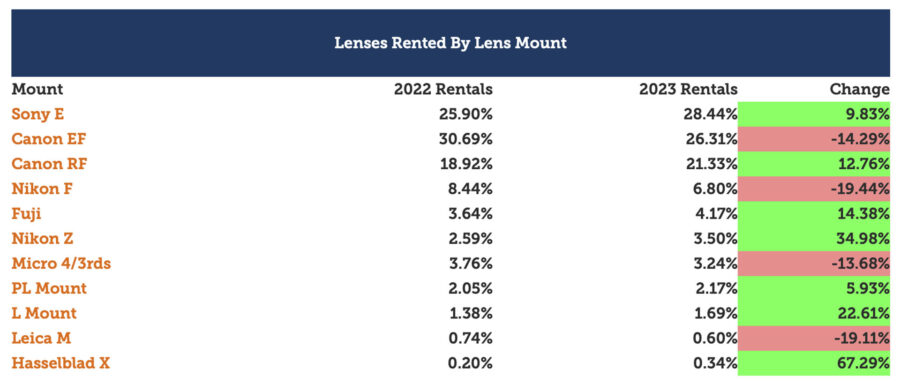

Dissecting the numbers by lens mount grants Sony the first lead. Converging influences create such an opportunity for the E-mount: Sony’s overall rise, a significant decline of the SLR-based EF mount, and the split between EF and RF. If combined, Canon’s EF and RF sweep almost half the yearly rental share. Nikon’s aging F-mount still clings to fourth place after the steepest decline of the year, and while gaining 34% compared to last year, the Z-mount still is in an unconvincing spot.

Off with the old, on with the new

Interestingly enough, the four mounts that saw the steepest decline are also the oldest ones, with some correlation to the mount’s age. The Nikon F-mount was announced five years after the Leica M-mount (1959 and 1954, respectively) as they are the oldest in this lineup. Both have an over 19% decline compared to 2022. Canon EF mount, the first completely electronic mount, was announced in 1987 and saw a 14% decline and the newer MFT, the first Mirrorless mount (on a digital camera) saw a 13% decline. This insight may be no more than coincidental convergence, but could also point to a direction of sort. We’ll have to wait and see.

Lies, damned lies, and statistics

When I’m trying to extract meaningful insights out of raw metrics (or in this case, not quite raw) I always regard the phrase, “Lies, damned lies, and statistics” which was popularized by Mark Twain. These numbers probably give a better understanding of LensRentals than they do for the entire market. Alas – stats are not that common so we work with what we have. Concluding the conclusions we may observe some undercurrents:

- The rise of mirrorless: It’s been a few years since DSLR gear reigned supreme, and this year’s stats leave no doubt about the trajectory. Even the mighty EF mount, probably the most adaptable electronic mount around is declining.

- Constant innovation works: There’s a correlation between innovation and rental share. Manufacturers who featured new (and significant) cameras recently saw a rise in rentals. Panasonic, FUJIFILM, and Sony provide the starkest example.

- Full-frame rules: Well, at least on the specific segment represented by the LensRentals roster. Bear in mind, that rental gear tends to lean towards the high end of the market, as these will more likely be rented, and not necessarily bought. Furthermore, LensRentals works with prosumers, consumers, and stills shooters, not just the film industry, so Super35 gear isn’t its prime. Now try to recall the single non-full-frame camera that made it to the top 10 most popular cameras of 2023…

- Rentals are still the domain of filmmaking: Even regarding all further disclaimers, each list leans towards motion capture. Video cameras distinctly dominate the popular cameras list, and all the stills-capable cameras there also boast formidable video capabilities.

What are your takeaways from this list? What trajectories did you see hiding in the numbers? How could this information affect your decision-making in the future? Let us know in the comments.