I’ll admit, I wait until the last minute to file my taxes, like thousands (millions?) of other people do. Many last-minute filers are facing a nerve-wracking issue today: an H&R Block server outage is preventing e-filing. This is a scary issue since filing your taxes late can result in pricey fines, but luckily there are other options.

Here’s a look at what’s going on with the H&R Block tax day server outage and how you can get around it for free.

H&R Block servers overloaded on tax day

Last-minute taxpayers using H&R Block tax software were hit with a frustrating surprise this weekend: an error preventing e-filing. The “Electronic Filing” tab on H&R Block tax software programs includes an “E-filing Alert” this year:

“You may encounter an issue when you attempt to e-file. We are aware and are working on it. Please try again later today or print and mail your return. Please refrain from reaching out to Customer Support at this point.”

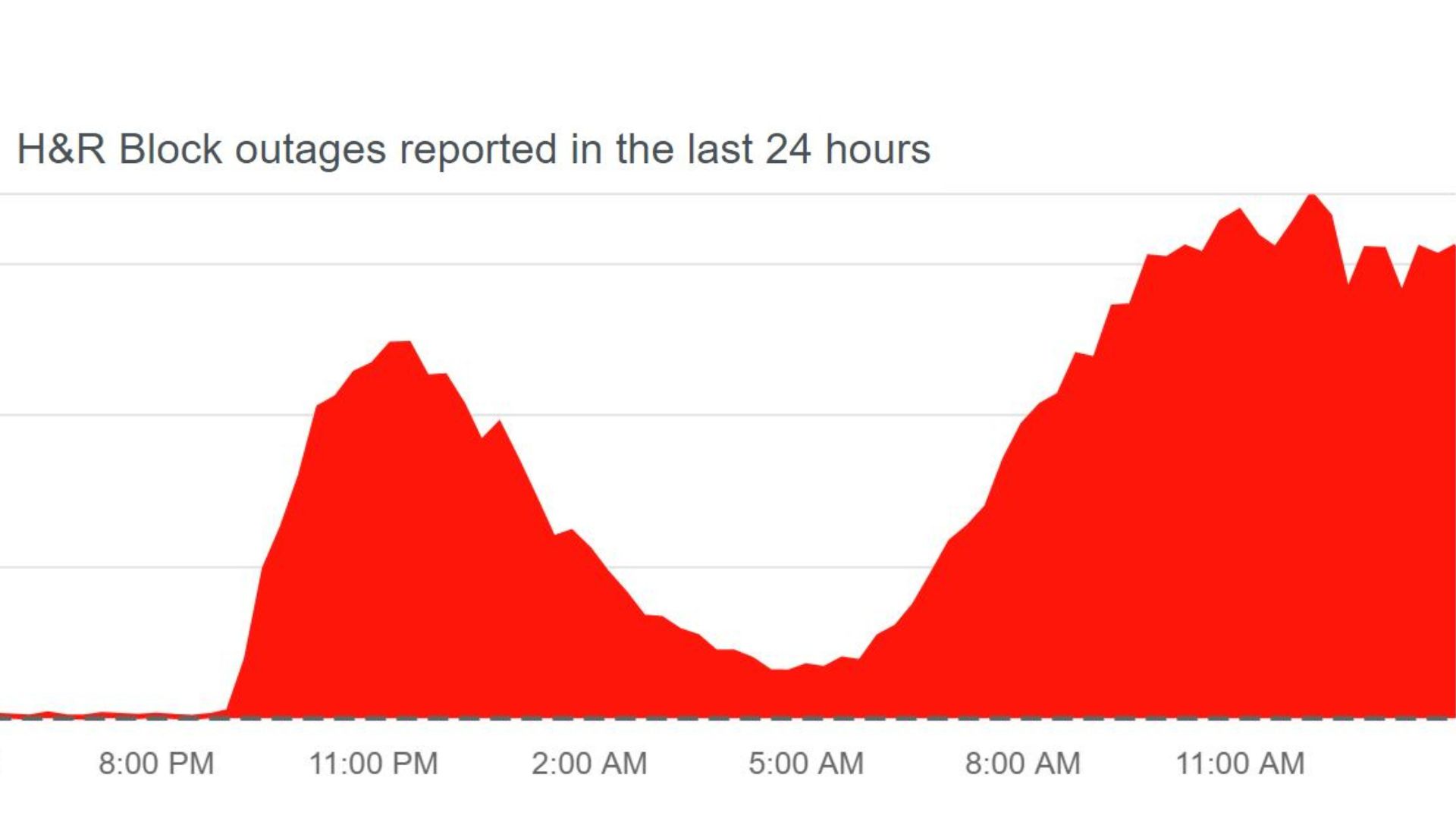

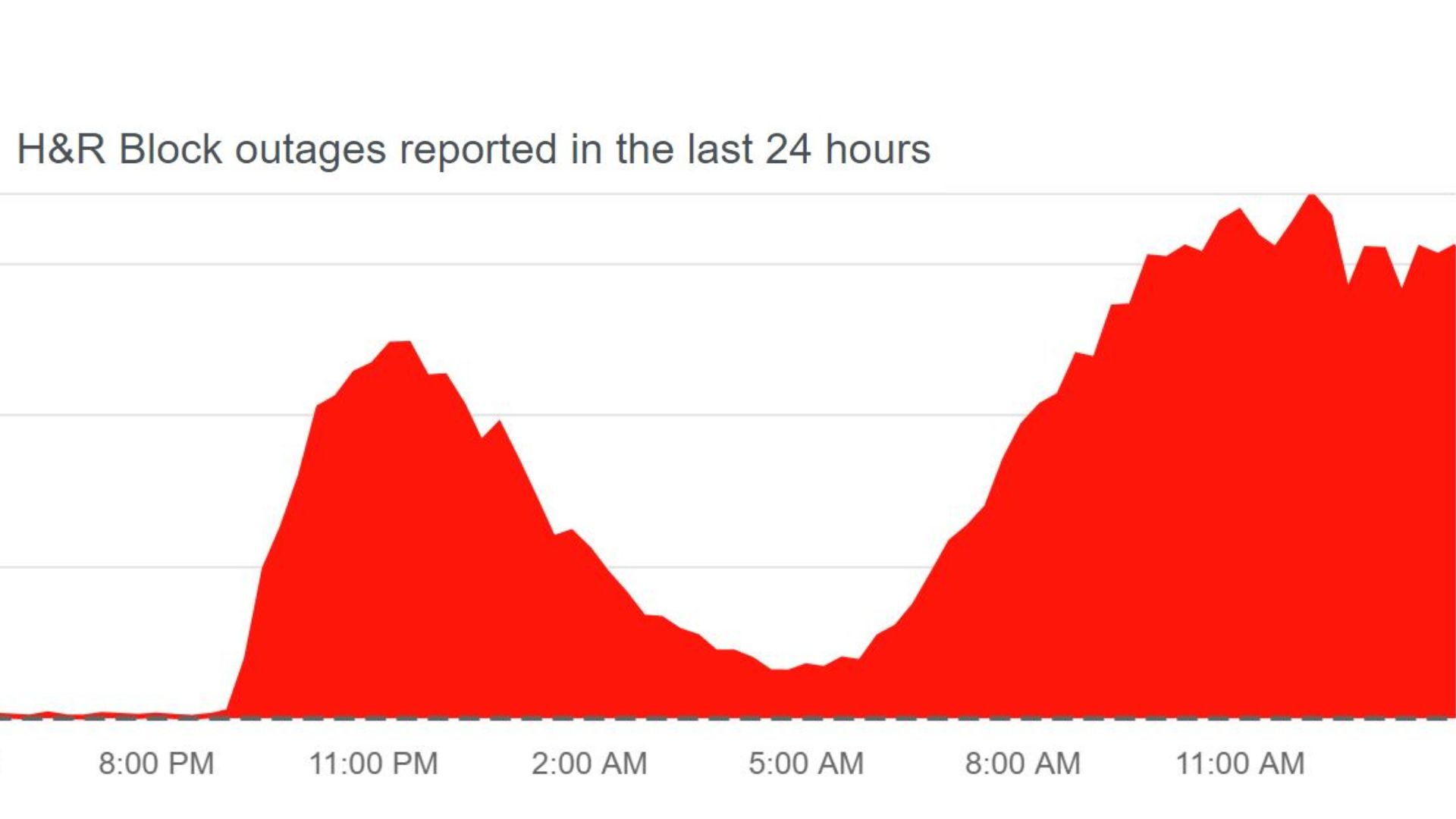

This issue started about 9 PM EST on Sunday, April 14, and at the time of publication, still hasn’t been resolved. There appears to be a server outage or overload that’s preventing e-filing requests from going through, leading to “Bad Gateway” error messages for thousands of users. Multiple attempts don’t seem to be doing the trick, either (although they are leading to a slew of pending charges on users’ accounts).

Things are looking grim for those of us who were planning to e-file tax returns today using H&R Block. You can keep an eye on things with Downdetector, but you don’t have to risk getting slapped with a fine for filing your taxes late due to the H&R Block server overload. There is another solution that’s free, easy, and won’t take long.

How to file your taxes for free without H&R Block

If the H&R Block server outage derailed your tax filing plans, don’t worry. There’s an easy workaround that won’t cost you any extra money. I used this method myself without any issues and it only took about half an hour.

Right now, you’re probably wondering how to file your taxes without H&R Block. Many people don’t know this, but the IRS provides a way to file your taxes for free without paying for any extra software. There are a few free programs out there, but I recommend simply using Free File through the IRS website. It uses fillable forms that function very similarly to H&R Block (there’s even a “Do the Math” button to help you out).

Using Free File is even easier if you already went through all the questions in H&R Block to file your taxes over there. You can print out your completed forms from H&R Block (or save them as a PDF) and plug in the necessary values in those same forms on Free File. If you have multiple forms to fill out, you can select “Add a form” and search through a list. Free File will save the forms when you jump between them and match up values between forms for you.

Copying my info over from H&R Block to Free File only took about 20 or 30 minutes. After that, I moved over to the “E-File Your Tax Forms” tab on Free File, filled out my e-filing info, and that was it. No server delays, no issues, and no extra fees. You’ll get a confirmation email from Free File with a link to check the status of your return, as well.

Overall, Free File was easy and straightforward to use and saved me from late filing fees due to the H&R Block servers getting overloaded.